No Credit Check Business Loans and Finance Options

Flexible finance designed as an alternative to traditional bank loans

When Is a No Credit Check Business Loan Necessary?

Many banks and online lenders conduct hard credit checks when businesses apply for loans. Especially for companies with a bad credit score, hard credit checks can negatively impact their score even further, making it seem almost impossible for these businesses to find a suitable financing option.

Fortunately, there are solutions designed for small business owners in this exact situation. Bad credit business loans, no credit check business loans, and other financing alternatives – read more about what different lenders offer below.

A poor credit score shouldn’t stop your small business from securing funding through our alternative, unsecured merchant cash advances.

How much capital does your business need?

Use our calculator and see how Rev&U™ could help your business.

£60,000

funding received

£100

for every card transaction

84% = £84

goes to your account

16% = £16

goes to 365 finance

Business Loans for Bad Credit

A merchant cash advance acts like a bad credit business loan, and is a fast and flexible way to raise capital funding, even if you have an adverse credit history.

Unlike secured business loans from banks, we don’t require any collateral or business plans, nor are there any hard credit checks necessary. As a merchant cash advance provider, we look at your business’ recent debit and credit card transactions and apply a soft credit check instead, meaning we don’t just rely on your credit history or score when deciding. Since we don’t apply a hard credit check when assessing your eligibility for a merchant cash advance, applying for one with 365 Finance won’t affect your credit score at all.

If your registered office is located in the UK, and your business processes payments through a card machine (PDQ) and/or online payment system, and has been trading for at least 6 – 12 months, you could be eligible for our unsecured business funding between £10,000 and £400,000, even if you have bad credit, or no credit history at all.

With no fixed monthly payments, interest rates or hidden costs, repayments are based on an agreed percentage of your credit and debit card payments. This way, you only pay us back when your customers pay you, while you can focus on running and growing your business. This is one of many reasons why our merchant cash advance is an ideal alternative to bad credit business loans for small business owners who find the process of applying for bank loans both arduous and difficult.

These are the benefits of our merchant cash advance at a glance:

- Easy approval: Submit your application online within a few minutes, you will receive your answer within 24 hours of submitting your application. Our approval rate lies at 90%.

- Simple requirements: We generally don’t require collateral or business plans. Even a low credit score does not stand in the way of your financing.

- Flexible terms: Repay your merchant cash advance with your future debit and credit card sales – without any interest rates, APRs or fixed payment amounts. This way you can pay back your business loan quickly and easily within 5 to 10 months.

Do I Qualify?

Qualification for our business cash advances is simple: Contact our customer services team to see if you are eligible.

In business for at least

12 months

Monthly credit and debit card turnover of at least

£10,000

When Is a No Credit Check Business Loan Necessary?

As a number that rates your credit risk, your credit score is one of the most important criteria when applying for a typical bank loan. There are several agencies in the UK that keep credit records and measure credit scores. However, if one of them gives you a good score, it’s likely that the others will do the same.

A high, ‘good’ credit score shows you can manage credit and deal with repayments well, whereas a lower, ‘bad’ credit score is usually caused by a bad credit history of either failed or late repayments.

Each time lenders conduct a hard credit check to confirm your eligibility for a loan approval, your credit score is impacted negatively. This is why applying for too many small business loans, and thus going through multiple hard credit checks, can be damaging to your long term ability to secure finance for your company.

Luckily, there are various finance options that only require soft credit checks, which have no impact on your credit score. This is where no credit check business loans come into play.

Types of No Credit Check Business Loans

You can apply for many types of no credit check business loans. To help, we’ve listed a range of options below. It’s important to keep in mind that some of these finance options may require hard credit checks in certain circumstances. If you are unsure whether a funding offer is possible without a hard credit check, it’s always best to research thoroughly and contact the lenders before you apply.

- Invoice factoring helps you avoid cash flow problems and ensures you can pay contractors and suppliers in good time.

- Microloans are mostly aimed at start-ups and can provide the finance needed to buy the essentials to get a business up and running.

- Business Credit Cards are typically based on the personal credit score of the applicant. These cards can be used for purchasing company-required goods and services.

- Working Capital can ensure that your business has the funds needed to carry out its daily duties, giving you the financial backing needed to keep operations running.

- Merchant Cash Advances are based on your business’ credit and debit card sales, as repayments are made through a small percentage of your future card sales. At 365 Finance, we offer merchant cash advances between £10,000 and £400,000.

How a Merchant Cash Advance Works

A merchant cash advance is an ideal type of no credit check loan. Instead of relying on your credit score, we assess your business’ recent debit and credit card transactions to determine affordability and produce a funding offer tailored for your business. Get in touch with our team today to receive a tailored quote. The loan application process is quick and easy, and we can give you a funding decision within 24 hours. There is no need for you to provide collateral or business plans, and we only conduct a soft credit check that does not affect your credit score. From this, we’re able to make a funding decision without running a hard check that will show on your credit report. Unlike a traditional bank loan, there are no interest rates or fixed monthly payments to worry about. Instead, repayments are taken from a small percentage of your future debit and credit card payments. We don’t require any APR as there is no fixed fee, just one all-inclusive cost that’s agreed on at the start, which never changes.

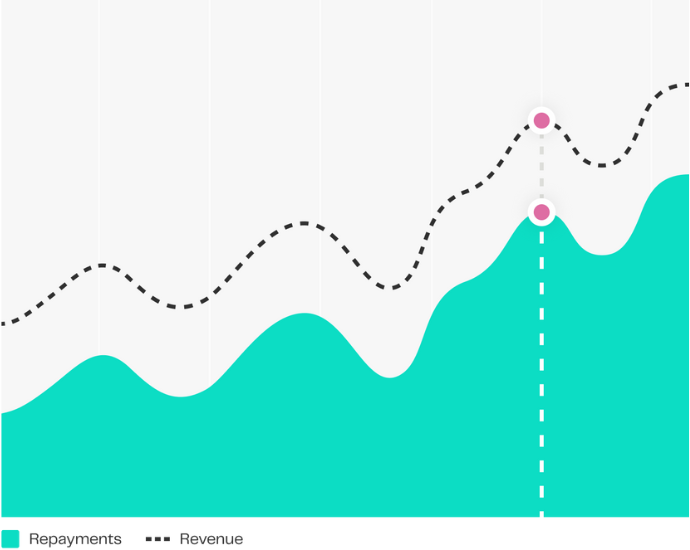

Repayments mirror the ups and downs of your business

A business processing £10,000/month in card sales can receive an unsecured cash loan of the same amount, with no interest rates or fixed terms. Repayments are automatic and based on a small percentage of monthly card sales.

How your repayments work

1

Agree fixed percentage

Agree a fixed percentage of your credit and debit card sales to repay the business cash advance (typically between 5% and 15% of your card sales)

2

Make card sales

Sell to your customers on your credit and debit card terminals.

3

Automatic repayments

The pre-agreed percentage is automatically deducted from your daily transactions at point of sale and you will.

4

Get money into your account

This is automated so there is no change to the time it takes for you to receive your money.

5

Daily sales reduce balance outstanding

The daily amount deducted then reduces the balance outstanding on the business cash advance.

6

Collections stop automatically

Collections stop automatically once the cash advance has been repaid in full.

Am I eligible for a Rev&U™ cash advance?

Has your business been trading for a minimum of 6 months?

Does your business’ monthly credit and debit card sales exceed £10,000?

You’re eligible

Get a quoteYou must take at least £10,000 per month in card sales and have been trading for at least 6 months

Request a callback

Finance Academy

Explore our Finance Academy to understand all the financial acronyms and jargon, and take charge of your business’s financial success today!

Explore our guidesA simple and secure way to finance your business

Apply in minutes

Complete the application form. It takes less than 5 minutes!

Relationship manager

Be allocated a relationship manager to assist with any queries.

Approval under 24h

A decision will be made under 24h.

Get your cash advance in days

Funding directly into your business bank account within days

Useful information

Finance Academy

Explore our Finance Academy to understand all the financial acronyms and jargon, and take charge of your business’s financial success today!

Explore our guides