Merchant Cash Advance

Flexible business finance designed as an alternative to traditional bank loans.

What is a Merchant Cash Advance?

A Merchant Cash Advance, also known as a Business Cash Advance, is an unsecured business finance solution that allows business owners to quickly raise funding. Unlike a traditional bank loan, there are no interest rates or fixed monthly payments. Instead, repayments are taken from a small percentage of your future debit and credit card payments. This means repayments mirror the ups and downs of your business, easing financial stress – when you have a quiet period, you simply repay less, and when business picks up, you repay more.

How a Merchant Cash Advance works with 365 finance:

A business that processes £10,000 per month in credit and debit card sales, is eligible to receive £10,000 in an unsecured business cash loan, with no interest rates or fixed terms. Repayments are automatic and deducted as a small percentage of your monthly credit and debit card payments.

Ideal for businesses that process payments through a card machine (PDQ) and/or online payment system, a merchant cash advance is a fast and flexible way to raise capital for your business:

- No APR or fixed monthly payments

- Over 90% of applications approved

- No security or business plans required

- Approval within 24 hours

Get a free quote today, and gain instant funding to grow and build the business you’ve always wanted. Requesting a quote will not affect your credit score.

Unlike a traditional loan, repayments mirror the ups and downs of your business.

Repayments are automatic and based on a small percentage of your monthly card sales. So when business is slow, repayments are low – and when business is good, you pay a bit more. Not only does this remove the stress of a traditional high street loan, it is also perfect for seasonal businesses.

How Merchant Cash Advance repayments work

1

Agree fixed percentage

We agree a fixed percentage of your credit and debit card sales to repay the business cash advance (typically between 5% and 15% of your card sales).

2

Make card sales

You sell to your customers on your credit and debit card terminals as usual.

3

Repay automatically

The pre-agreed percentage is automatically deducted from your daily transactions at point of sale.

4

Receive money in your account

There is no change to the time it takes for you to receive the remaining money from your sales.

5

Reduce balance outstanding

The daily amount deducted reduces the balance outstanding on the cash advance.

6

Stop automatically

Collections stop automatically once the cash advance has been repaid in full.

Am I eligible for a Merchant cash advance?

Has your business been trading for a minimum of 6 months?

Does your business’ monthly credit and debit card sales exceed £10,000?

You’re eligible

Get a quoteYou must take at least £10,000 per month in card sales and have been trading for at least 6 months

Request a callbackUK Business Cash Advance: The flexible alternative to bank loans

For small to medium sized enterprises (SMEs), bank loan applications can be a lengthy, arduous process that makes borrowing money difficult.

Our financing acts as a quick loan that immediately injects cash into your business, eradicating the long processing times of traditional bank loans, making it an ideal solution for small businesses.

Whether you have poor credit history or your application rejected by the bank, your business could still be eligible for a cash advance. Raise between £10,000 and £400,000 in unsecured funding for your business today.

There’s no APR or fixed terms to worry about — instead, you’ll receive simple, easy to understand funding that’s designed to help you successfully run your business.

Also, once you have a merchant cash advance with us, you can easily renew and top up your funds with no hassles.

Simple, quick, easy funding to grow your business

A merchant cash advance is the ideal funding for merchants looking to grow and expand their business. Use your debit and credit card sales to raise capital for your business, today.

Instantly receive funds to use on any business requirement, such as:

- Increase your working capital to pay employees, suppliers and other creditors to fuel business operations and avoid cash flow problems.

- Purchase equipment, vehicles and other items to increase efficiency and develop a stronger, more effective business.

- Expand your business by opening up a new location, hiring more staff or launching new products, services and offers.

- Advertise your existing products and services to bring in new customers and grow your sales revenue.

- Purchase the lease on your premises to own your location and enhance your retail or food service business.

Benefits of a merchant cash advance vs a business loan

At 365 finance, we offer unsecured business funding to thousands of SMEs in the UK, particularly businesses operating in the hospitality, retail, and leisure industries. Our funding is an affordable and flexible alternative to a bank loan, and a great option for merchants looking for quick, short term finance. In comparison to traditional bank loans, the benefits of a merchant cash advance include:

- 90% approval rate

- Approval within 24 hours

- No interest rates, APRs or fixed payments

- No late penalties or hidden fees – agree on one, upfront cost that never changes

- Flexible repayments based on a small percentage of your future debit & credit card sales

- No security or business plans required

- Bad credit or poor credit history isn’t a barrier to receive funding

- Short repayment period, with the advance typical repaid within 5 to 10 months

- Repayments are automatic and simple, as they are processed via transactions taken from your card machine

A merchant cash advance responds to the dilemmas commonly faced by small to medium sized businesses in the UK that are faced with unexpected bills and fluctuating sales revenue.

Choosing the right business loan for you: What you need to consider

Unsecured vs secured business loans

Banks often require security when taking out a loan, usually in the form of a tangible asset such as commercial property, stock, machinery, or a vehicle.

If your business becomes bankrupt or insolvent, the bank can sell the asset to recoup costs. As such, a secured loan from the bank usually entails a lengthier application process, as there are due diligence processes to conduct such as valuations, legal costs and business checks.

Our funding is unsecured, in that we don’t ask for security in the form of a tangible asset like a bank would. Therefore, we can process your application within 24 hours, offering you speedy access to capital.

However, the cost of our funding may in some circumstances appear more expensive, as we are providing business finance without security. This is why your business’ trading history is very important to us, as we need to feel that your business generates enough cash flow to repay the loan amount.

A merchant cash advance responds to the dilemmas commonly faced by small to medium sized businesses in the UK that are faced with unexpected bills and fluctuating sales revenue.

Merchant Cash Advance Repayments

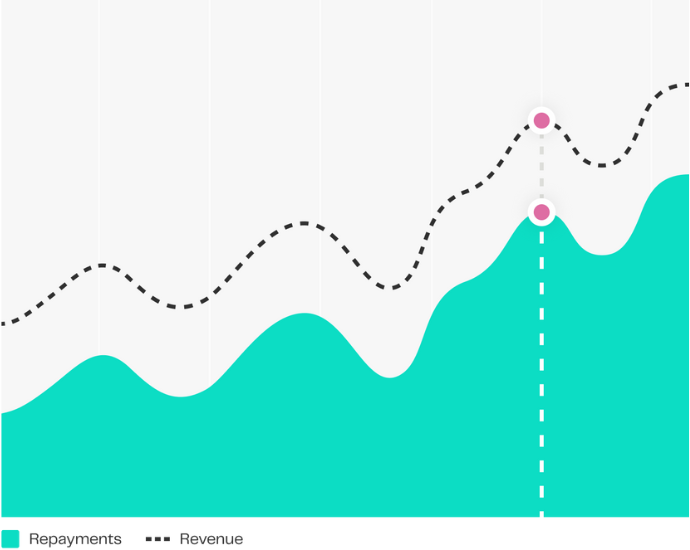

Traditional bank loans have fixed monthly repayments, with a set repayment period. As these repayments are fixed, you are obligated to pay a set amount each month irrespective of underlying business performance – this can cause financial stress for your business, impacting cash flow.

Our funding requires no fixed monthly repayments. Instead, there is only one, all-inclusive cost that is agreed upfront and never changes – there’s no APR, hidden fees or late penalties.

Repayments are automatically deducted from a small percentage of your card sales, meaning you only repay when customers pay you. As such, your business’ sales revenue isn’t negatively impacted.

Repayment period is typically between 6 to 10 months, however this is flexible depending on individual circumstances.

If card sales only make up a small portion of your overall business revenue, then this can impact the total amount of funding we can offer you, as we only evaluate business turnover through your credit and debit card sales.

How a Merchant Cash Advance Works

A merchant cash advance is an ideal type of no credit check loan. Instead of relying on your credit score, we assess your business’ recent debit and credit card transactions to determine affordability and produce a funding offer tailored for your business. Get in touch with our team today to receive a tailored quote. The loan application process is quick and easy, and we can give you a funding decision within 24 hours. There is no need for you to provide collateral or business plans, and we only conduct a soft credit check that does not affect your credit score. From this, we’re able to make a funding decision without running a hard check that will show on your credit report. Unlike a traditional bank loan, there are no interest rates or fixed monthly payments to worry about. Instead, repayments are taken from a small percentage of your future debit and credit card payments. We don’t require any APR as there is no fixed fee, just one all-inclusive cost that’s agreed on at the start, which never changes.

Am I eligible for a Rev&U™ cash advance?

Has your business been trading for a minimum of 6 months?

Does your business’ monthly credit and debit card sales exceed £10,000?

You’re eligible

Get a quoteYou must take at least £10,000 per month in card sales and have been trading for at least 6 months

Request a callbackHow much capital does your business need?

Use our calculator and see how Rev&UTM could help your business.

£60,000

funding received

£100

for every card transaction

84% = £84

goes to your account

16% = £16

goes to 365 finance

A simple and secure way to finance your business

Apply in minutes

Complete the application form. It takes less than 5 minutes!

Relationship manager

Be allocated a relationship manager to assist with any queries.

Approval under 24h

A decision will be made under 24h.

Get your cash advance in days

Funding directly into your business bank account within days

Useful information

Finance Academy

Explore our Finance Academy to understand all the financial acronyms and jargon, and take charge of your business’s financial success today!

Explore our guides