Your Guide To Ecommerce Funding

Written by Team 365 finance

Ecommerce businesses have been in a unique position to weather the storm of the pandemic better than other industries.

Demand surged as government restrictions were put in place and consumers turned to online marketplaces for their goods. Ecommerce’s popularity even reached as much as 37% of all retail transactions in January 2021.

Here at 365 Finance, we’ve also seen a 47% increase in the demand from online businesses for flexible business funding. As a provider of revenue financing, this dramatic rise seen year-on-year, when compared to 2020, shows how fast online businesses are expanding, requiring extra finance.

However, given the rising demand in ecommerce businesses, the financial world hasn’t evolved to meet the funding demands of budding ecommerce companies.

If you’re considering starting an ecommerce business or are trying to secure ecommerce business loans, this is the article for you. We’ll break down the ins and outs of ecommerce funding, including common pitfalls, and identify solutions you can use to acquire reliable and flexible ecommerce financing.

What are some common ecommerce funding challenges?

The online purchasing penetration in the UK has demonstrated an exponential increase year-on-year since 2008, highlighting that the ecommerce industry shows no signs of slowing down in the near future.

But what about the challenges ecommerce businesses face when it comes to accessing loans and business funding? Whether you’re just getting started as an online trader or are growing your store to new heights, read on to learn some common ecommerce funding challenges.

Obtaining security

Traditional bank loans often require some form of a tangible asset that you can list as collateral when taking out a business loan. The aim is to provide the bank with security so they can recover any losses if you’re unable to meet the payments.

In this case, businesses usually supply collateral in the form of commercial property, stock, machinery or a vehicle. For an ecommerce business, this can be difficult, as they often don’t have a physical shopfront or equipment and machinery to submit as collateral.

Start-up costs of online businesses can also be minimal in comparison to other industries, as they don’t need to invest in a commercial property or expensive equipment like a hospitality business would, so they are less likely to have collateral they can utilise as security for a loan.

A certain sub-set of ecommerce businesses, drop-shippers, feel this hurdle particularly harshly as well. Dropshipping is a completely stock-free business model, so — with no tangible assets to secure against their loans — drop-shippers face a higher barrier to entry than most.

If you opt for an unsecured business loan instead, you risk paying higher interest rates and a lower maximum loan value. Although banks are trying to limit their exposure in the absence of collateral, such loan conditions can limit your growth potential, too.

A low credit score or sparse credit history

You may also face hardships with traditional lenders on the account of being new to the business world, as banks are hesitant to lend to potential borrowers with little to no credit history or a poor credit score (simply on account of having no borrowing history).

In this case, you may be forced to opt in to higher interest rates than you’d prefer, adding further pressure to your business and balance sheet at the end of the month.

Fixed loan fees

Ecommerce businesses tend to operate on slim margins. Analysis by Alvarez & Marsal in 2020 shows net profit margins are around 4.5% within Europe, with similar figures shown in the US.

As a result, fixed loan payments can be highly restrictive for ecommerce businesses. If your revenue falls suddenly, you’re expected to make the required minimum payment regardless.

Unfortunately, making the shortfall can be highly stressful and ecommerce financing options need to be more flexible to support seasonal and trend-based business models.

(Depsite the growth of the ecommerce industry, obtaining finance can still prove hard for some online retailers.)

Ecommerce financing: What options do you have?

Ecommerce businesses have limited options when trying to source financing.

While you can reinvest your profits from previous sales, the biggest limitation is your existing revenue. You can only ever invest as much as your net profit within a given month. After expenses, there isn’t always much left, and slower months can be especially draining on your growth.

You can also explore equity financing, although this is reserved for limited companies. Equity financing can help keep your debt down, however shareholders may require a cut of your profits soon after, thereby reducing your take-home pay as a result.

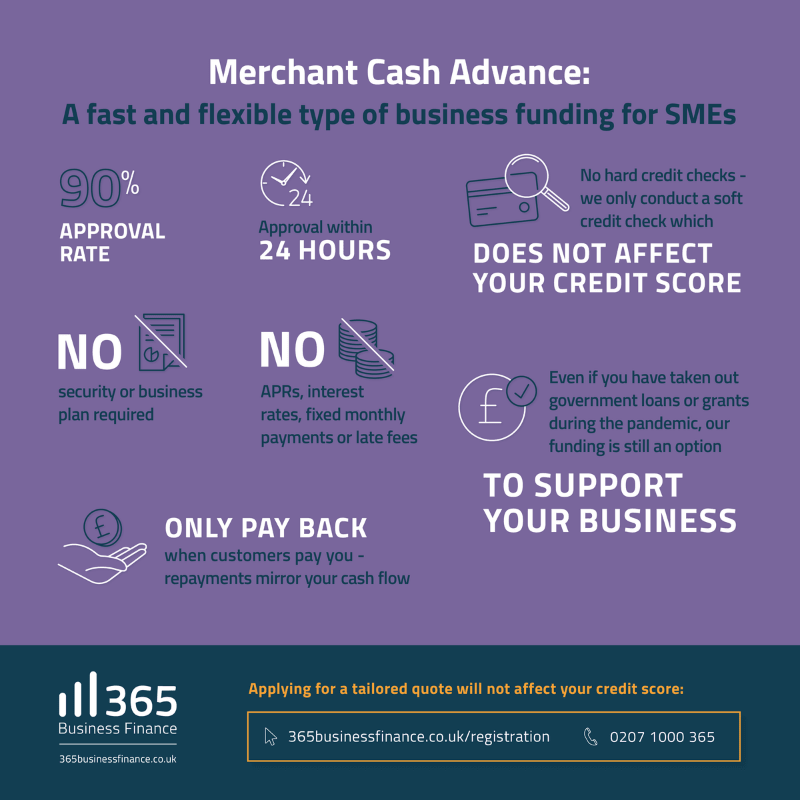

This is where revenue financing can help online businesses, as they are a type of business loan that provides flexible and fast funding without the need for security, APRs, or fixed monthly payments.

What’s revenue financing?

Revenue Financing (also known as a business cash advance), is a form of unsecured business financing, offering access to sums between £10,000 and £400,000. Revenue financing is suitable for ecommerce businesses processing at least £10,000 a month, and that has been trading for six months or more.

365 Finance is typically able to fund up to 100% of your business’s monthly credit and debit card turnover. For example, if your business processes around £10,000 per month in online transactions, you could be eligible to receive up to £10,000 in business funding.

How does revenue financing work?

Providers of revenue financing like 365 Finance assesses your business’ transaction history to determine your affordability. We consider things like how consistent your sales are over a given period and how long you’ve been able to maintain them. Once our analysis is complete, we then produce a funding offer that’s tailored to your business.

Unlike a traditional bank loan, there are no interest rates or fixed monthly payments to worry about. Instead, repayments are taken from a small percentage of your future online transactions, meaning you only repay when customers pay you.

This approach means you don’t have to worry about meeting fixed payments each month, as your repayment is always proportional to your revenue. When sales are good, you pay back a higher amount, but if they dip unexpectedly, so do your payments — matching your performance seamlessly.

Do I need a good credit score for revenue financing?

Unlike bank loans that involve length approval processes, revenue financing is still available to you if you have no prior borrowing history or a poor credit score.

365 Finance approves around 90% of applications and businesses receive their funds within a few days, so revenue financing is a strong alternative to bank loans.

How much does revenue financing cost?

At 365 Finance, we charge a flat fee that’s included in your cash advance sum. This fee is dependent on your average monthly online sales, as well as the total amount of funding you require.

Our fixed-price approach means that there are no hidden costs (like early-completion loan fees) or an interest rate slowly increasing your borrowed sum.

Altogether, our approach helps reduce your overheads and maximise your margins from online sales.

What can I use revenue financing for?

Revenue financing doesn’t stop at giving you flexibility in repayments. As a type of unsecured ecommerce business financing, you can invest the advance to suit your business best. Ecommerce businesses typically use revenue financing for:

– Website development

– Equipment upgrades

– Monthly website running costs

– Search Engine Optimisation (SEO)

– Marketing and advertising costs

– Stock purchase

– General working capital needs

– Expanding your product line

So whether you need to meet the oncoming demand for mobile optimisation in ecommerce, go all out on a marketing campaign as a direct-to-consumer brand, or simply need to restock, revenue financing give you total control.

Grow your ecommerce business with smart funding options

The future is digital, and ecommerce is only set to grow. Regardless of whether you’re looking to start an ecommerce site, join an existing platform or grow your online presence, choosing the right funding option is essential.

Traditional business loans are a time-tested method for businesses, but they’re not always the most accessible or fast at providing investment capital. New business products like revenue financing hold the key for ecommerce businesses to grow successfully without compromising on the flexibility they need.

Access flexible ecommerce financing with 365 Finance

Interested? If you’ve been trading for six months or longer, we can help you access finance when you need it most.

We offer between £10,000 and £400,000 in unsecured revenue financing for UK SMEs with no APRs, hidden fees, or fixed monthly payments.

Contact us today to see how we can help your business reach its full potential.